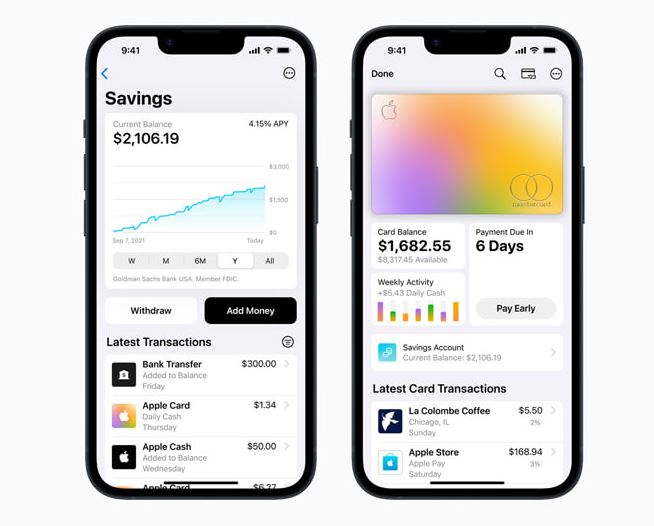

Apple has recently announced a new feature for Apple Card users, which enables them to grow their Daily Cash rewards by linking their card to a Savings account from Goldman Sachs. This Savings account provides a high-yield APY of 4.15%, which is more than 10 times the national average. Users can set up and manage their Savings account directly from their Apple Card in Wallet, without any fees, minimum deposits, or minimum balance requirements.

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, explained that this new feature will help users get more value out of their Apple Card benefit while offering an easy way to save money every day. The goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly, all from one place.

Once a Savings account is set up, all future Daily Cash earned by the user will be automatically deposited into the account. Users can change the Daily Cash destination at any time, and there is no limit on how much Daily Cash users can earn. Additionally, users can deposit additional funds into their Savings account through a linked bank account or from their Apple Cash balance.

Users will have access to an easy-to-use Savings dashboard in Wallet, where they can track their account balance and interest earned over time. Users can withdraw funds at any time through the Savings dashboard by transferring them to a linked bank account or to their Apple Cash card, without any fees.

This new feature builds upon the financial health benefits that Apple Card already offers, with no fees, Daily Cash on every purchase, and tools that encourage users to pay less Apple Card interest. The new Savings account from Goldman Sachs provides users with an opportunity to save more money while offering the privacy and security that users expect from Apple.