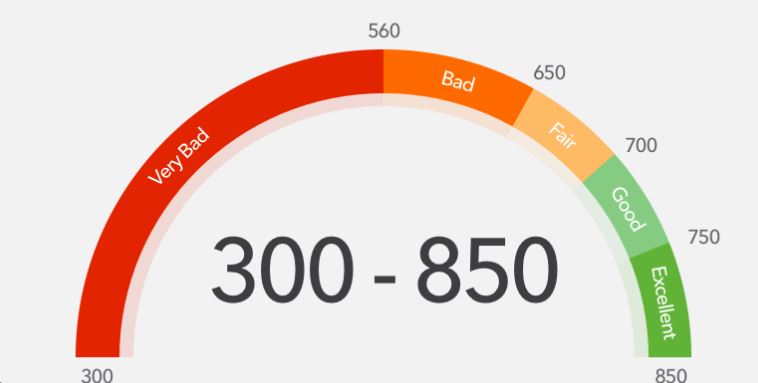

Your credit score is an important indicator of your financial health, and having a score of 700 or higher can open up many opportunities for you, such as access to better credit terms, lower interest rates, and more. If you’re looking to boost your credit score, here are some tips to get you started:

Check your credit report: The first step to improving your credit score is to know where you stand. Request a copy of your credit report from one of the three major credit bureaus (Equifax, Experian, or TransUnion) and review it for errors or inaccuracies. Dispute any errors you find and have them corrected.

Pay your bills on time: Your payment history is the most important factor in determining your credit score, accounting for 35% of the total. Make sure to pay all your bills on time every month, including credit card bills, loans, and other debts. Set up automatic payments or reminders to help you stay on track.

Reduce your credit card balances: Your credit utilization ratio, or the amount of credit you’re using compared to your total credit limit, is another important factor in determining your credit score, accounting for 30% of the total. Aim to keep your credit utilization below 30% of your total credit limit. If your balances are currently high, focus on paying them down as quickly as possible.

Build a credit history: If you’re new to credit or have a limited credit history, it can be more challenging to achieve a high credit score. Consider opening a secured credit card or becoming an authorized user on someone else’s account to start building a credit history.

Avoid opening too many new accounts: While it’s important to have a mix of credit types, opening too many new accounts at once can lower your credit score. Only apply for credit when you need it and space out your applications over time.

By following these tips, you can start working towards a credit score of 700 or higher. Remember that building good credit takes time and consistent effort, but the benefits are well worth it in the long run.