Credit cards are an integral part of modern-day commerce, enabling consumers to make purchases and access credit lines with ease. However, the history of credit cards can be traced back to the early 1900s, when charge plates were first introduced. These early versions of credit cards were made of metal and used by local merchants to extend credit to their customers. The plates were used to identify customers and track their purchases, with payments being made at the end of the month.

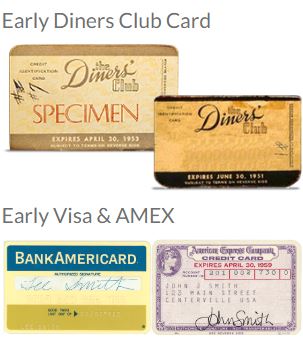

The first general-purpose credit card, known as the Diners Club Card, was introduced in 1950 by businessman Frank McNamara. The Diners Club Card was primarily aimed at businessmen who traveled frequently and needed a way to pay for expenses while on the road. The card was initially accepted at just 27 restaurants in New York City, but quickly grew in popularity and expanded to other cities.

In 1958, Bank of America launched the BankAmericard, which is now known as Visa. The BankAmericard was the first credit card to be offered on a national scale, and it quickly became a popular method of payment for consumers. Other banks soon followed suit, and by the 1970s, credit cards had become a common feature of American life.

In the 1980s, credit card issuers began offering rewards programs and other incentives to attract customers. These rewards programs have evolved over time, with many credit cards now offering cash back, travel rewards, and other perks to customers who use their cards for purchases.

The 1990s saw the rise of online commerce, and credit cards became an essential tool for making purchases on the internet. Credit card companies adapted to this new landscape by introducing new security measures to protect consumers from fraud and other risks associated with online shopping.

Today, credit cards are an essential part of the global economy, with millions of people using them to make purchases and access credit lines. While the technology has evolved significantly over the years, the basic concept of a credit card remains the same – a convenient and secure way to make purchases and access credit.

Pingback: How To Build Your Credit - Chase Deals